With AI, Qapter has the capability to detect damaged parts, determine the type and severity of damage, define appropriate vehicle manufacturer repair operations and create an estimate based on these pre-defined repair operations. Automation tools improve the process of triage claims workflow, speed up reviews of damage photos, rapidly improve identification of total loss vehicles, and support identification of the next best action for repairable vehicles. These capabilities all save time, speed up the claims process and shorten the life-cycle of a claim for insurers, body repair centres, assessors and vehicle owners.

By blending the company's proven repair science technology with over 300 million historical claims, one billion historical images (and growing), and 50 years of experience, Solera's best-in-class data feeds enhanced machine learning algorithms to drive efficiency and increased accuracy. This integrated approach provides superior accuracy and performance compared to rudimentary standalone simple AI image recognition point solutions that have limited repair data and provide minimal benefit in digitising the claims process.

As noted by Darko Dejanovic, CEO, Solera, "Implementing AI will drive huge efficiency gains, but above all, the extent of such gains are determined by accuracy. This accuracy depends on the quality, not just the quantity, of the data and images that are used to train the algorithms, as well as the supporting historical damage estimate. This historical data more thoroughly trains the algorithms, not simply on the repair itself, but also on the broader context of the damage."

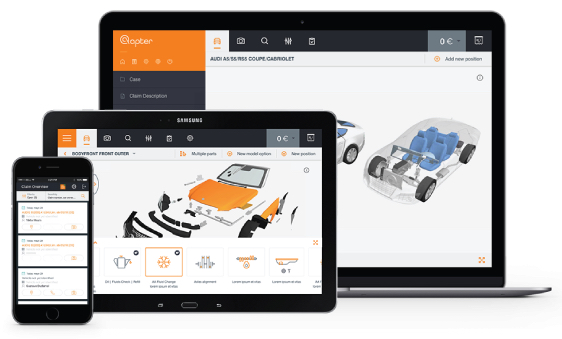

The industry has already begun to evolve to meet unexpected market conditions brought on by the COVID-19 pandemic with an enhanced focus on providing digital-first and touch-less claims experiences for customers which support social distancing while protecting employee and customer health and safety. As an example, Solera's image capture capabilities allow for initiation of a claim through a fully digital interaction where the customer provides images of vehicle condition and damage directly from their phone to the insurer or repairer, eliminating the need for face-to-face interaction.

"With leading claims platforms currently available throughout North America, Europe, Latin America and Asia Pacific, we are excited to provide even more value to our customers by making current platforms 'smarter' through the use of AI and supporting a seamless transition from existing solutions to the new platform. We'll be working closely with our customers to deliver this functionality over the coming months and provide regular releases across markets," continued Dejanovic.

For more information about Solera's approach to AI in the claims workflow see Qapter.